Traditionally when someone needs money, they approach a bank for a loan, but there are two problems associated with this. The first is that banks have a lot of criteria to meet and a very time consuming and elaborate process to get a loan, and the second is that the interest rate might be too high in current economic conditions.

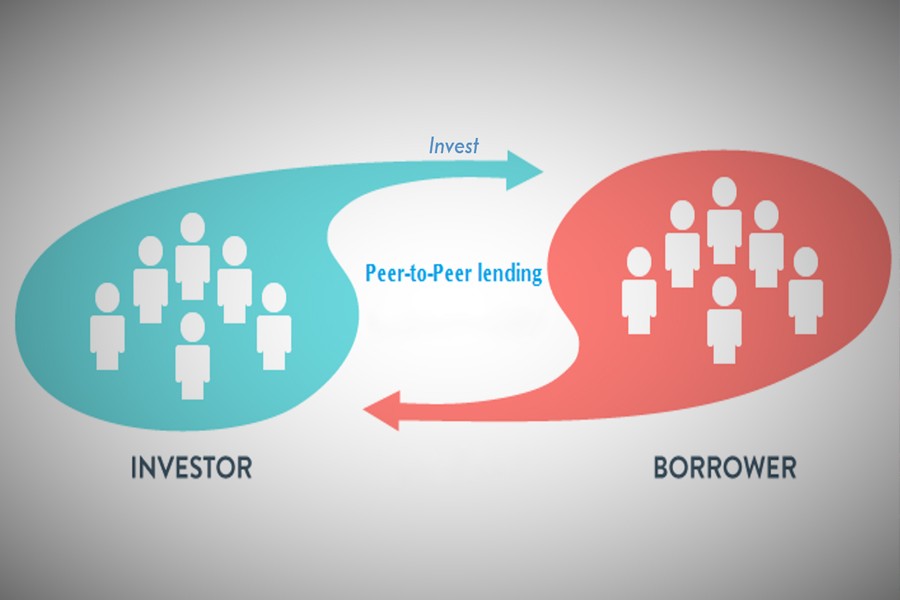

This is where peer to peer (P2P) lending comes in as a bridge between these two extremes. P2P lending — aka person-to-person, or social lending — anonymously matches up borrowers and lenders via an online platform using complex computer algorithms. Some of the top global P2P lending platforms are the Lending Club, Prosper and Upstart.

The platform first allows the borrowers to request loans for various needs. The lenders see these loan requests and can choose whom they give money. The platform provides them with all sorts of information about the borrowers so lenders can make educated decisions. Some might settle for lower returns and only lend to safest borrowers, while others can go for higher yields but accept a higher degree of risk. And lastly, the platform takes a small cut for their service of making the deal.

The personal loan usually ranges from $1,000 to $40,000 although higher amounts might be available for small businesses. And the terms of the loans range from one to five years. The platform automatically deducts free monthly payments from the borrowers from their verified bank accounts. The P2P marketplace has no physical branches which lower the cost of borrowing and increases returns to lenders.

At the moment, there does exist a P2P platform in Bangladesh called Projekt.co but it is yet to be popular. However, recently there has been a steady increase in the use of branchless banking and cashless payments the form of Bkash, SureCash and Rocket. And the future of FinTech looks brighter every day.